and then click Employer

Master.

and then click Employer

Master.W-2 Employer Maintenance

Use W-2 Employer Maintenance to maintain the employer information to print on the employee W-2 forms and to transmit the W-2 file electronically. You must also enter the tax year for the year that you are processing W-2s.

Notes:

It is important that you maintain all W-2 Employer fields unless the directions indicate otherwise.

All entries must be in UPPER CASE only. Do not use punctuation.

Generally maintaining the W-2 Employer information is the first step in setting up for W-2 reporting. For more information on the timing and sequence of steps, see the W-2 Forms Process.

Directions:

To open from W-2 Processing click Settings

and then click Employer

Master.

and then click Employer

Master.

Or click Utilities

from the menu. Then

click Misc Utilities, click

W-2 Utilities and click

Employer..

Or, use the keyboard

shortcut: [ALT] [t] [u] [w]

[e].

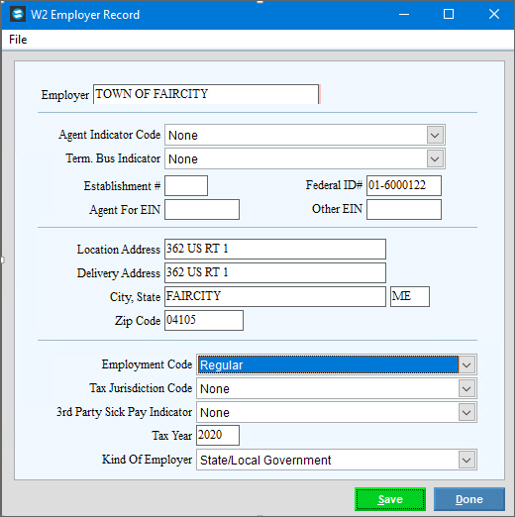

W-2 Employer Maintenance Window Example:

W-2 Employer Maintenance Prompts |

|

|

To update the new or changed information, click Save or press [ENTER]. Keyboard shortcut: [ALT + s] |

To avoid losing data, you must save new or changed information. |

|

Employer Name |

Enter the name of your company or organization. (up to 50 characters) |

Agent Indicator Code |

Select the appropriate choice in the drop-down list:

|

Term. Business Indicator |

If you have terminated your business during the tax year, select Business Terminated. Or, to indicate the business is active, select None. |

Establishment Number |

If you have multiple employee locations, such as, multiple stores that will be in the same W-2 file using the same EIN number (Employer Identification Number), use this field to identify the store or factory location or types of payroll. You can use any combination of letters or numbers for the Establishment Number. (up to 4 characters) Note: If you do not have multiple locations, please leave this field blank. |

Federal ID# |

Enter the Federal ID Number assigned to your company or organization. (9.0 numeric, (-) hyphen optional) |

Agent For EIN |

If an Agent Indicator Code was entered, enter the Agent EIN. (9.0 numeric, (-) hyphen optional) |

Other EIN |

If you submitted a Form 941 or a Form 943 to the IRS or W-2 data to the SSA for this tax year and you used a different EIN then the Employer EIN, enter the other EIN. (9.0 numeric, (-) hyphen optional) |

Location Address |

Enter the employer location address, such as, Attention, Suite, or Room information. (up 22 characters) Tip: The Location Address does not print on the W-2 forms. |

Delivery Address |

Enter the employer delivery address, such as, the street or P.O. Box address information. (up 22 characters) Tip: The Delivery Address prints in Box C of the W-2 forms. |

City |

Enter the name of the city for the employer address. (up 22 characters) |

State |

Enter the two-character Postal Service state abbreviation for the employer address. (2 characters) |

Zip Code |

Enter the Zip Code or the zip+4 Code for the employer address. (up to 11 characters) |

Employment Code |

To specify the type of employer, select a choice in the drop-down list:

Required |

Tax Jurisdiction Code |

To specify a tax jurisdiction, select a choice in the drop-down list:

|

3rd Party Sick Pay Indicator |

To specify a Sick Pay Indicator, select None or Third Party Sick Pay. |

Tax Year |

Enter the four-digit tax year to report. (4.0 numeric, yyyy) Important: The tax year needs to be updated each year. |

Kind of Employer |

To specify the type of employer, select the Kind of Employer code in the drop-down list.

|

|

To exit

the maintenance, click Done.

Or, click Close |

Editing Employer |

1. Position the pointer to the information that you want to change. 2. Enter the changes. 3. To complete the process,

click Save

|

Deleting an Employer |

Note: To maintain data integrity, you can not delete the W-2 Employer. |