Customer Daily Interest

Daily interest can be assessed for

that are set up for interest. There is a Daily Interest Calculator

Window on the Invoices

View of the customer inquiry that can be used to calculate interest

on a customer's outstanding balance. To launch the calculator click

Daily Interest. To see daily

interest on a future date for open item customers you can use Cash

Receipts Entry - Future Interest Owed Window.

To see details of how the interest is calculated, click Information in the Interest column beside the desired invoice. The

Interest screen displays. You can

change the Interest Through date if needed. To print the interest

details including customer and location details, right-click within the

Interest Calculation screen and click Print.

in the Interest column beside the desired invoice. The

Interest screen displays. You can

change the Interest Through date if needed. To print the interest

details including customer and location details, right-click within the

Interest Calculation screen and click Print.

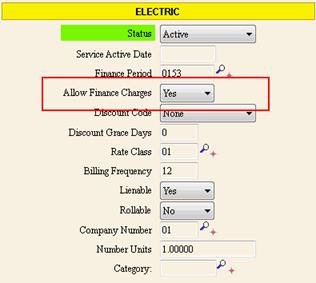

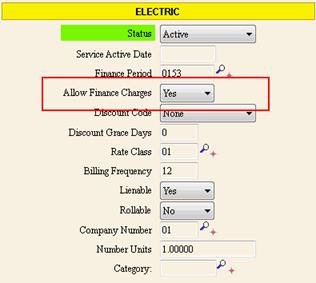

Setting Up a Customer for Open Item

Daily Interest

1. In order for a customer service

to be considered for open item interest the account's service finance

charge setting must be set to Yes.

Go to the Customer Service wizard and set the option

to Yes.

Other Setup for Assessing Interest

1. Build an open

item interest payment transaction code and add it to the appropriate

cash

profiles. The transaction code will route the money to a GL

account for tracking purposes.

2. Build the Open

Item Daily Interest tables for each rate class within each service.

This holds the rates and the grace days. A balance qualifies

for interest if there is a balance after the determined starting date

plus the number of grace days maintained on the Open

Item Daily Interest Maintenance.

3. Interest can be calculated

starting from the bill date or the due date, which is determined by the

Application

Options setting Calculate OI Interest

by Due Date. If the Due Date is to be used the Application

Options setting Calculate OI Interest from Due Date must be set to

Yes.

4. If the Application

Option Freeze Daily Interest Until Next

Bill is set to yes:

Then, the

interest calculation will check the desired interest through date

against the last billed due date for the location on the invoice.

If the through date is <= the last billed due date, then

the actual date used to calculate interest through will be the last

*billing* date instead. This means that once billed, interest

on the balance forward is effectively frozen until after the last

due date.

And if the

payment date is <= the last billing date, the interest calculation

does NOT use the last billing date and works like normal. See

WI 2593.

5. If the Application Options Use

latest bill from any service is set to yes along with the Freeze Daily Interest Until Next Bill option,

then you can select a single service, or ALL services, or None (which

is the default). When calculating interest for an invoice with

a service code matching this setting, it will use the latest billing/due

date of all services. If the calculation date is <= this

last due date and >= this last billing date, interest will only be

calculated up to the last billing date, effectively freezing interest

during that period until it passes the last due date. WI

#3240.

Daily Interest Notes

The

daily interest rate is the annual rate from the interest table / 365.25.

Daily

interest calculation is:

[number of days past due] * [daily interest rate (annual rate from

the interest table / 365.25)] * [charge balance at the time]

Interest already paid and regular payments are factored into

this.

If the

invoice balance excluding payments is <= 0, interest is not calculated.

How

an invoice balance qualifies for interest - The due

date is used as the date when interest starts getting calculated.

If the due date is blank, then the billing

date + 30 days is used. If the billing date is blank, then

the billing post date is used as the date interest is calculated from.

The date is compared to the grace days set on Open

Item Interest Maintenance and will not calculate until it is greater

than the given through date + grace days. If the invoice qualifies

for interest, then the number of days from the bill date or due date

(determined by the Application

Options setting Calculate OI Interest from Due Date setting)

plus grace days is used for the calculation.

Lien

Interest - If the Application

Options setting Calculate OI Interest from Due Date is set to

yes, then the due date is used for interest calculation and daily

interest is calculated on liened/rolled invoices after they have been

liened/rolled. Lien costs are excluded from the principal in

interest calculations. When calculating lien interest in between

payments the calculations will always use the interest factors that

fall within the time period of the due date.

If there

is an invoice stop date, it is factored into several places. If the due date above

is >= this interest stop date, then interest is not calculated. Or when it is calculating

partial payment blocks as soon as it reaches the interest stop date

it stops accumulating interest.

Partial

payments are taken into account. From

the determined due date, it loops through each payment by date and

calculates the daily interest between each payment to account for

the interest already paid and the number of days between each payment

and the charge balance at that time (it is possible further charge

adjustments could be added to the invoice). Interest

paid was added as a field to the invoice detail whenever interest

is paid.

Daily Interest Calculation Example

Annual interest rate of 14%, so the daily rate is 0.0383299110%.

No grace days.

The billing date is 04/01/20 with a balance of $100. There is

a payment on 05/01/20 of $20, a payment on 06/01/20 of $20. The

due date was 05/01/20 but doesn’t factor into the equations only that

it now starts calculating interest as of the billing date:

Start

Date |

End

Date |

Days |

Balance |

Payment |

How

much of payment was Interest |

04/01/20 |

05/01/20 |

30 |

100 |

20 |

1.15 |

05/01/20 |

06/01/20 |

31 |

80 |

20 |

0.95 |

06/01/20 |

07/01/20 |

30 |

60 |

0 |

0.67 |

07/01/20 |

07/01/21 |

365 |

60 |

0 |

8.39 |

|

|

|

60 |

0 |

|

in the Interest column beside the desired invoice. The

Interest screen displays. You can

change the Interest Through date if needed. To print the interest

details including customer and location details, right-click within the

Interest Calculation screen and click Print.

in the Interest column beside the desired invoice. The

Interest screen displays. You can

change the Interest Through date if needed. To print the interest

details including customer and location details, right-click within the

Interest Calculation screen and click Print.